At Big Society Capital, we know that charities and social enterprises are central to our mission to improve the lives of people in the UK. One of the reasons we invest is to help these organisations grow and/or become more resilient, thereby building a stronger social sector and helping them deliver more impact on people’s lives.

But how does social impact investment affect enterprise growth and resilience? As part of a pilot in partnership with Access – the Foundation for Social Investment, we have been exploring why organisations (or “investees”) take on investment, and how they plan on achieving their aims. This is vital because it gives us insight into the intention of the investee and lets us look back and understand whether (and how) they achieved what they set out to do. This in turn allows us to draw conclusions on our impact on the growth and resilience of social sector organisations (and, to a certain extent, on the people these organisations ultimately help – which is difficult and complicated to measure otherwise).

For example, we frequently hear that there are some investees who have no intention of growing – they are happy with the size they are. They might be taking on a loan to simply bridge a gap until their next contract. On the other hand, in some of our other funds, the emphasis is all about growth – quickly iterating a product until it fits a market, and scaling rapidly. It’s not fair to think of the growth and resilience of these two organisations in the same way.

This led us to search for a standardised approach that we could use to categorise the different reasons organisations take on investment (or, as we call it, a “taxonomy”). We wanted something that was as comprehensive as possible, with clear definitions, that could apply equally to a small tech-for-good start-up receiving a venture investment and to a large charity issuing a bond. Standardisation and universality are key as it would allow us to respond to trends and make sure unmet demand for finance can be met, helping fulfil our role of connecting social enterprises and charities with capital. It would also help our fund managers spot new opportunities and analyse past performance. Over time, this can help all of us focus on what supports the sector the most.

Identifying the gaps

As we spoke to our partners, it became clear to us that there was no standard way of looking at why organisations took on social investment. Everyone had their own categories, often with unclear or confusing definitions. Our own existing system wasn’t any better – these were the options:

- Growth Finance

- Restructuring Finance

- Development Capital

- Working Capital

- Asset Finance

- Acquisition

- Infrastructure

- Other

How is growth finance different to development capital? What’s the line between asset finance and infrastructure?

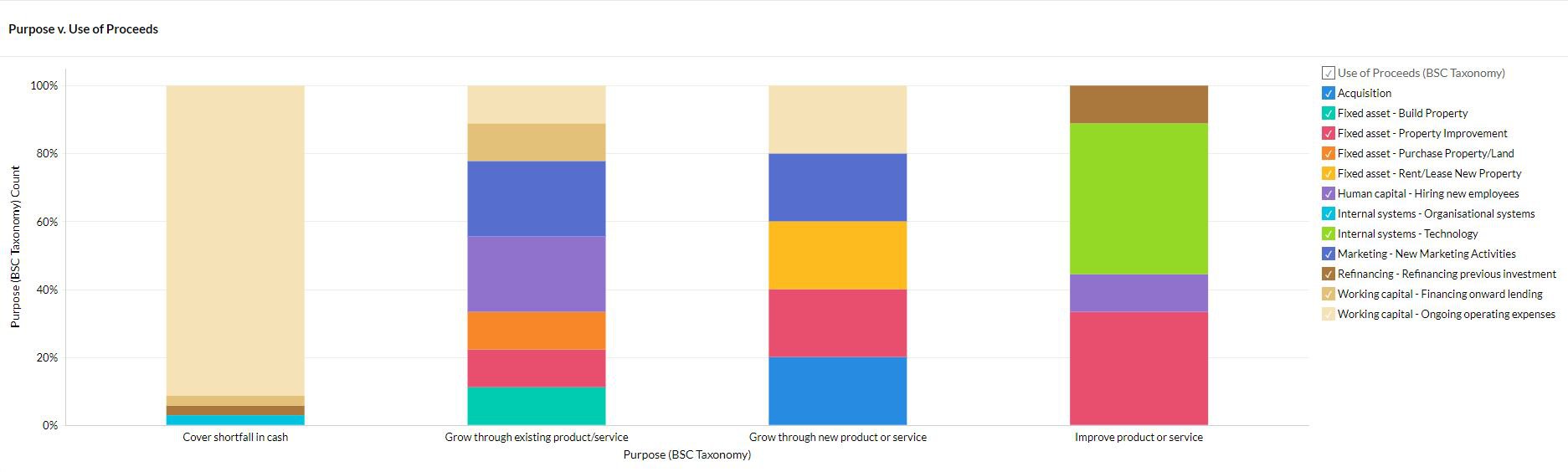

Our other finding was that there was often conceptual confusion over the difference between “use of proceeds” and “purpose of investment”. In our mind, use of proceeds is what you actually spend the money on: a new building, hiring more staff, repaying an existing loan. Meanwhile, purpose is why they are spending the money the way they are – to expand into a new geographical area, to improve their existing product, to generate long-term cost savings. The two are not the same, and you can mix and match between the two: for example, you could be buying a new building in order to start serving a new local area, or it could be because you’re getting a good deal on a headquarters office which will save you money on rent in the long term. Again, we were guilty of making the same mistake – “growth finance” could capture lots of things, from an acquisition to asset finance – all of these could be used to grow.

Creating a standardised approach

Having identified a need for a clear and comprehensive approach, we set out by interviewing some of our fund managers, as well as tapping our own internal experience, to get a sense of the different ways organisations used social investment.

The result is two taxonomies – one for Use of Proceeds and the other for Purpose of Investment, to maintain the distinction – a collective synthesis of our partners’ insight and time, for which we are very grateful.

Applying the approach to a fund

Our partners at Social Investment Business (SIB) helped us test the taxonomies, applying it to the Resilience and Recovery Loan Fund (RRLF) portfolio.

Jenny Smith, Learning Lead at SIB, shares the results of applying the approach to the fund below.

A standardised approach to categorising the purpose of loans and cash spend was welcomed by SIB as we continually pursue more comparable data sets to understand our customers and their needs in the sector. The two new taxonomies created a portfolio-level perspective on what the RRLF loans were used for.

Over 60% of deals had a purpose of ‘Covering Shortfall in Cash’ and were using its proceeds for ‘Working Capital – ongoing expenses’- somewhat unsurprising knowing that the purpose of RRLF was to support charities and social enterprises that were experiencing disruption to their normal business model as a result of COVID-19.

More revealing analysis came from cross referencing these taxonomies with other organisational information. For example, a higher proportion of organisations with a purpose of loan of ‘Covering Shortfall in Cash’ had a primary revenue of Business 2 Customer, compared to other loan purposes. A lot of deals agreed in mid/late 2020 included assumptions around ‘the world going back to normal’ after the first lockdown, something particularly important for organisations relying on trading with customers. Moving forward, SIB is interested in how these purposes of loans and use of proceeds change over time now these assumptions have been proven wrong. This will help us understand how our customers are adapting to the changing environment and what other support they may need as they do so.

SIB carried out the RRLF portfolio analysis retrospectively. We are now in the process of integrating this collection of data in a live and systematic way – recording it at application and deal stages and tracking any changes during monitoring.

What’s next

The above is a great example of what we can do with this data once we have a standard way of collecting it – added power comes when you combine this data set with the other data fund managers hold on investments.

We know that the taxonomies aren’t perfect yet, and there are still practical questions about how to apply them. We’ll keep working on them and keep you updated as we iterate.

If you are a fund manager, we would invite you to start applying the taxonomies to your portfolio and seeing what insights you can start to draw already. We would love to hear about your experience, as well as any feedback and suggestions – please do get in touch.