Earlier this year Big Society Capital launched its Ideas for Impact programme to identify ideas to tackle social issues which had the potential to take on social investment as a way to scale and support multiple social organisations through an investment fund or similar structure.

As this was our first real foray into providing development funding to support new ideas outside of Big Society Capital’s immediate network, we did not know quite exactly what to expect.

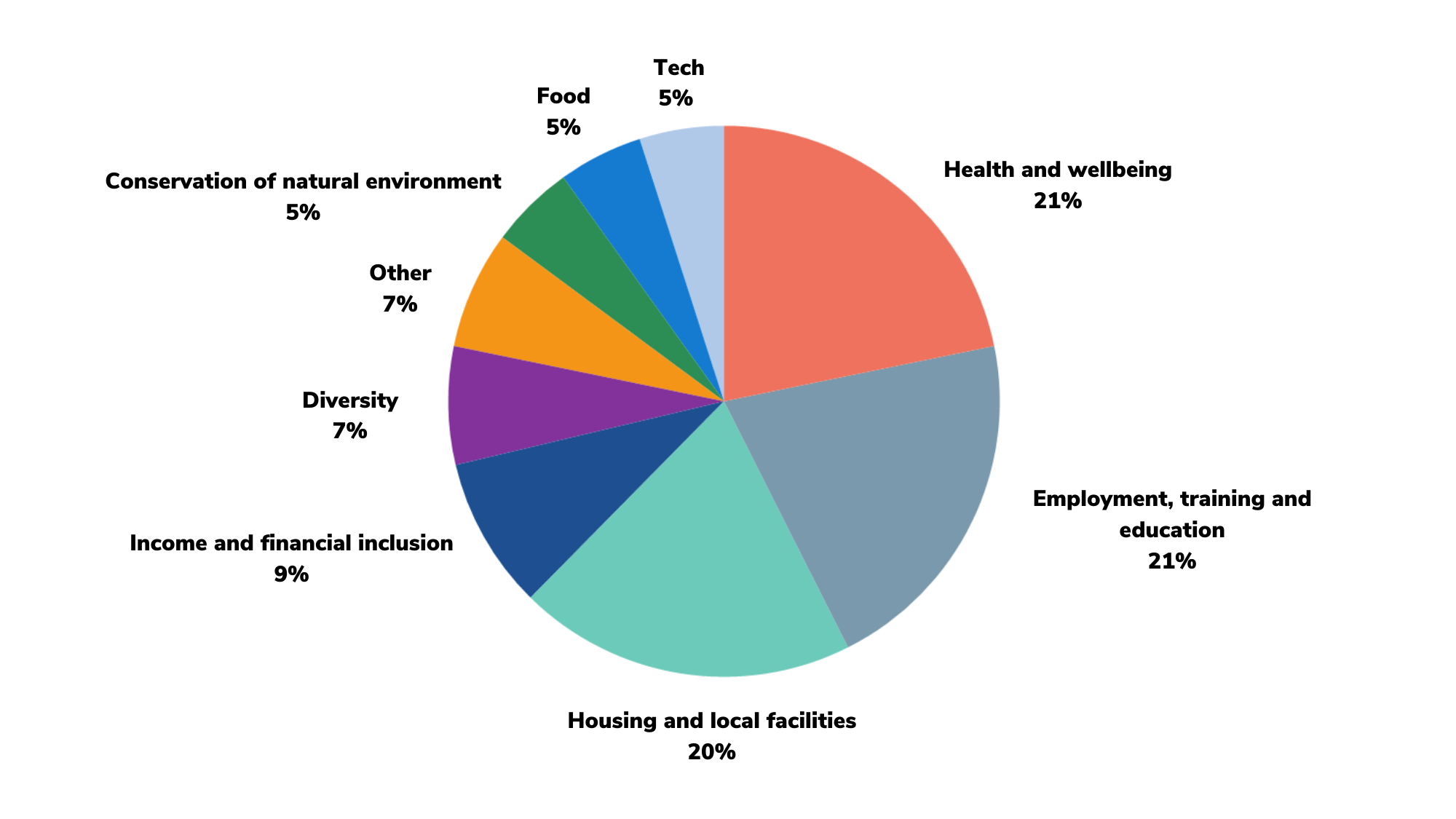

With support from dissemination partners including Social Enterprise UK, Ashoka and many others, we were thrilled to receive 106 applications. The ideas tackled a broad range of social challenges, with three popular themes:

- Health and wellbeing

- Employment, training and education

- Housing and local facilities

With support from an expert panel and our in-house sector expertise on social issues, we prioritised seven exciting ideas that met our selection criteria (social issue, business models, investment, partners, stage of idea and team). These will receive a combination of development funding and support from Big Society Capital staff.

The final seven ideas were chosen either because they are tackling a social issue needing continued innovation (e.g. diversity in social entrepreneurship/investment) or because the fund used a new finance solution (e.g. shared upside between fund manager and charity).

The ideas were:

Tackling youth unemployment

Social business support organisations Catch22 and Hatch Enterprise have partnered up with socially motivated tech investor Social Tech Trust to develop a programme and fund to support organisations in creating solutions to tackle youth unemployment. Together they will amplify the impact of these organisations, helping them to grow their impact and revenues by accessing public sector contracting opportunities.

Sunil Suri, Head of Ventures and Innovation at Catch22 says: “As we've seen over the past year, partnerships rooted in solidarity and a vision for a positive future are critical if we are to drive much-needed change.”

Refurbishing homes for homelessness charities

Social enterprise Cornerstone Place hopes to create a new fund that will support the development or refurbishment of properties to rent to homelessness charities, with the fund taking development risk on properties and using an innovative revenue sharing model.

"We are thrilled that Big Society Capital has recognised the potential of Cornerstone Place to address homelessness in a sustainable way at a time of critical need,” says Cornerstone Place co-founder Richard Kennedy.

Creating affordable housing using church-owned land

Charity North East Churches Acting Together is looking to scope opportunities to unlock church-owned land and buildings in the North East for affordable and assisted housing.

Rev Joanne Thorns, Regional Officer at North East Churches Acting Together, says: “The need for good and affordable housing is a big issue for the country, with around 8 million people living in unsuitable accommodation. Churches are often in an ideal place to understand the needs of their community and may have assets that can be used.”

Addressing workplace inequalities

Think-tank Resolution Foundation is scoping a proposed venture fund to invest in ‘tech for good’ ventures that improve working lives for low-paid and insecure workers; addressing structural challenges in UK labour market around rights, progression and skills.

“We are very pleased to be supported by Big Society Capital - their expertise and knowledge of the sector will provide a great boost to our plans in this area,” says Louise Marston, Director of Ventures at Resolution Foundation.

Supporting frontline organisations through the recovery

Many social and community enterprises across the UK are set to lose the properties they own as a result of the pandemic. Social investment fund manager Resonance wants to tackle this, through scoping the appetite and market for a distressed assets fund that looks to purchase properties and lease them back to social and community enterprises on an initial rent-free basis to support their recovery.

Growing a circular economy

Social investment consultancy organisation Social Finance is testing the feasibility of a circular economy outcomes fund, in partnership with ReLondon (previously London Waste and Recycling Board). It aims to grow the circular economy, fund outcomes such as reduction of waste and CO2 emissions, and support purpose-led organisations with a circular mission at their heart.

New tool for measuring diversity, equality and inclusion

Social enterprise support organisation UnLtd is working together with social investor Big Issue Invest to build and share an online tool where social enterprises are able to understand and improve their diversity, equity and inclusion practices and policies.

What we learnt

Like all pilot programmes, we are keen to learn from this process and in sharing these learnings with the wider social investment sector find ways to support the social innovation ecosystem collectively. The learnings we have captured include:

- There were clear trends around the social issues being tackled: We were able to group the 27 shortlisted ideas into eight clusters: housing; ventures; ideas that utilise a diversity lens; democratising finance; community assets; public sector transformation and the circular economy. This brought to light emerging trends: for example, there was a clear trend towards supporting community assets and rebuilding places – particularly acute in light of Covid as well as ideas framed around how best to support underserved diverse entrepreneurs and enterprises.

- There was high demand for development funding to support early-stage ideas that can potentially take on social investment: Whilst we are looking to support some of these ideas with £150,000 of development funding our budget is limited, meaning that there is a need for more funders to support this space.

- There were fewer collaborative ideas: We did not receive as many applications from social organisations partnering up with fund managers as we had hoped for. We believe this shows that there is more to be done to support these collaborative approaches.

- There was a clear need for the right funding and investment mix to support ideas getting off the ground: This will require a combination of grant funding and catalytic investment that can support more early-stage ideas.

Where do we go next?

We are looking to engage and support the seven ideas over the year and we’re excited to see how they will develop over time. We are also working to support twenty of the other applicants that we haven’t been able to support through signposting them to relevant funders and engaging them with networks such as the Social Impact Investor Group – which is a link to the catalytic investment space. At the same time, we are continuing to learn how to support innovative fund models, how we can work with the wider social investment sector to share learnings, and, more broadly, how we can work alongside other partners to further develop the social innovation ecosystem across the UK.