What we do

We start with the social issue, then aim to identify the sustainable business models that will create impact and improve people’s lives. We focus on those models that can attract other investors, as ultimately these will scale and have greater impact.

How we do it

As a wholesale social impact investor, we invest in fund managers. Over 75% of our investments have been into first time teams, funds or products. They, and the social enterprises and charities they invest in, create the impact. Our role is to bring the most relevant experts from our network to the table, generating ideas and connecting capital to where it’s most needed.

How we will judge success

By investing our capital, we aim to build a thriving ecosystem which has strong impact-driven fund managers and more available finance from diverse sources. We will judge our ultimate success by the growth and social impact of the broader environment we help create, not just the direct impact of our investment capital.

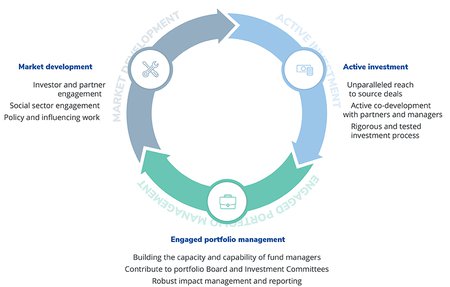

Investment life cycle

The five key elements of our approach

Since 2012 we have learnt how to build effective teams and processes to deliver on our mission. The critical factors that underpin our work are:

-

A learning culture driving open decision making

We believe that building a culture of learning, discovery and a willingness to fail is vital to our success. We aim to design solutions around the needs of beneficiaries, enterprises, intermediaries, policymakers and investors, and to do that we must be constantly learning.

-

Market creation not market failure

To build solutions to tough social challenges we must be proactive. This involves starting with the social issue, considering sustainable enterprise solutions, then designing routes that bring together the needs of enterprises and investors. We want to transform the broader investment ecosystem delivering long-lasting change to people’s lives.

-

Understanding our role alongside others

We need to listen and understand when it is most appropriate to use investment to help address social challenges, and how we collaborate with partners to tackle those issues. We understand in a fast-moving environment, where we can add value is constantly evolving and we must adapt to that.

-

A tri-lingual approach

We need to understand and engage with the social sector, the financial sector and government to understand social issues, connect investment to organisations with a social purpose and shape the broader environment that can help social impact investment succeed. We have built a team with multi-sector skills and experience.

-

Bias to action

We believe an important part of our role is to move first and learn by doing. One way we achieve this is by encouraging staff to take ownership of our mission and back their ideas.

Our ESG approach

We understand that our ESG approach is integral to achieving our mission “to improve the lives of people in the UK through investment with a sustainable return”. We focus on ESG risk identification and mitigation, guided by our Responsible Business Principles.

You may also be interested in

-

Learn more

Learn moreAdding value to our managers

We take an active role after we make an investment to achieve impact.

-

Learn more

Learn moreApply for investment

We invest in fund managers who want to create a better future.

-

Learn more

Learn moreBuilding our portfolio

How we design our portfolio to achieve our goals.

Contact

If you'd like to learn more about our investment approach, please get in touch.