2021 investments

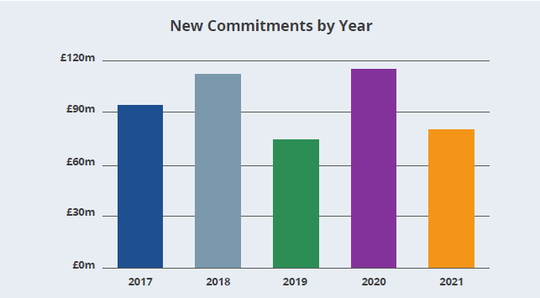

In 2021 we made 12 new commitments totalling £80 million. This, alongside more than £319 million from co-investment, means a total of nearly £400 million of committed investment to funds across our market system areas in the year.

| Investment Name | Market System | Commitment | Investment Summary |

|---|---|---|---|

| CBRE UK Affordable Housing Fund | Social and affordable housing | £20m | Follow-on investment – Affordable Housing Fund (AHF) aims to provide equity-like financing for registered providers to deliver affordable and social rental housing in the UK. CBRE Global Investors (CBRE GI) is seeking to raise £250 million for its launch. |

| Recovery Loan Fund | Social lending | £15m | Structured match commitment to lend to special-purpose vehicle set up by Social Investment Business, designed to leverage the Government’s Recovery Loan Scheme Guarantees to deliver loans to the social sector. |

| Charity Bank Co-investment Facility | Social lending | £10m | Follow-on investment of co-investment facility, to enable Charity Bank to make larger loans to a wide range of charities and social enterprises. |

| Man Community Housing Fund | Social and affordable housing | £10m | Community housing fund to work with local authorities and housing associations to provide and deliver affordable housing. |

| Resonance Everyone In Fund | Social and affordable housing | £7.5m | Property fund to acquire homes for people at risk of homelessness in London, in partnership with Greater London Authority and National Association for the Care and Resettlement of Offenders (Nacro). |

| Balderton Growth Capital* | Impact venture | £5.1m | Late-stage venture fund seeking to support UK and European start-ups with global ambition to further their Sustainable Future Goals. |

| Resonance Community Developers Fund | Social lending | £5m | Blended finance fund, focused on supporting community groups to develop and own assets, particularly with a focus on housing and sports. |

| Ananda Social Venture Fund IV* | Impact venture | £3.5m | Early-stage venture capital fund, focused on scaling UK and European impact-driven for-profit enterprises. |

| Balderton VIII* | Impact venture | £1.5m | Early-stage venture fund seeking to support UK and European start-ups with global ambition. |

| Charity Bank | Social lending | £1m | Follow-on equity investment to provide additional regulatory capital, to enable Charity Bank to grow its existing loan book. |

| Fair by Design (Poverty Premium Fund) | Impact venture | £1m | Follow-on investment into a fund for the development of an ecosystem to eliminate the poverty premium in the UK. |

|

Northern Impact Fund – Key Fund (Access) |

Social lending | £0.3m | Development of the Northern Impact Fund, which offers blended loan/grant capital. |

* Commitments in foreign currencies are stated in GBP equivalent

Our commitments for 2021 are in line with the long-term trend, although lower than 2020, which saw a number of specific Covid-19 commitments.

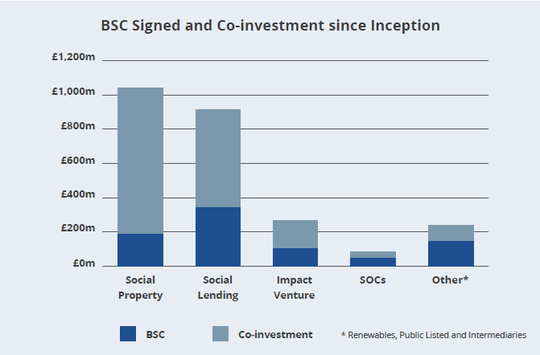

Our commitments in each market system, alongside the total committed by us with co-investors.